Small business owners are anxiously waiting to see if Congress will inject more money into the Paycheck Protection Program (PPP), the federal rescue program that failed to reach the vast majority of small businesses it was intended to help the first time around.

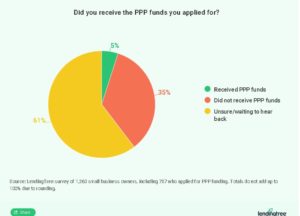

A new LendingTree survey found that just 5% of business owners have received a PPP loan, though 60% had applied for funding. Survey respondents were eager to submit their applications once the program opened, but many struggled to communicate with bankers as the entrepreneurs’ financial situations further deteriorated — and then the $349 billion emergency funding ran out of funds after 13 days.

Many of the 1,260 small business owners surveyed expressed their frustrations.

“I’ve kept my employees on payroll even though we closed because it is the right thing to do,” one respondent said. “Unemployment in our state is only $275 per month. They can’t live on that. Now, I’m in limbo waiting for the PPP money. I have no idea when, or if, it comes through. We’ll be ruined if I kept them on and the money doesn’t come through.”

Key findings

- Even when small business owners applied quickly, many have not seen a penny. About 6 in 10 respondents completed their PPP applications within the first five days (April 3-7). Even so, only 5% have so far received funding.

- 57% of small business owners had problems applying for PPP funds, with many citing inconsistent communication from banks and a lack of clarity about required documents.

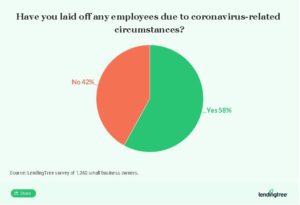

- 58% of entrepreneurs surveyed have laid off employees due to coronavirus-related circumstances, a 21 percentage-point increase from the prior month. Accommodation and food services was the hardest-hit industry, with 82% laying off workers.

Small business owners struggle to find emergency funding

The intent of the PPP was simple: Forgivable loans available through the U.S. Small Business Administration (SBA) would help small business owners keep employees on their payroll during the coronavirus pandemic, which has shuttered businesses across the nation.

But the program had challenges from the start, delaying much-needed relief for small businesses. Of the 1,260 small business owners we surveyed, 757 applied for a PPP loan through an SBA-approved lender; just 35 respondents who applied for PPP funding had received loans. About a third of respondents — 35% — weren’t approved for funding, while 61% are still waiting for a decision.

Parke Atkinson, owner/operator of a College H.U.N.K.S. Hauling Junk and Moving franchise in Virginia Beach, Va., submitted an application for a PPP loan at 11:15 a.m. on April 3. As of April 20, Atkinson still had not received an approval decision from the SBA.

“Our [moving] leads began to fall as soon as the state of Virginia mandated stay-at-home orders,” Atkinson said. “We had just come out of our slow season and prepared for a big May-through-October busy push. If this did not come to fruition, or was delayed by a number of months, I wanted to ensure my employees were paid and had not sought other means of making a living when things did pick up.”

It may be too late for those who have not yet been approved.

The SBA stopped accepting PPP and Economic Injury Disaster Loan (EIDL) applications on April 16 — less than two weeks after it began accepting them from small businesses and sole proprietorships on April 3 — stating that all allocated funds were spoken for. Independent contractors and self-employed business owners had an even shorter window: the SBA began accepting their applications on April 10.

Still, there is a chance the programs could be revived. Congress is nearing a deal to allocate an additional $310 billion to the PPP, with another $50 billion for the EIDL.

PPP loan application process presents hurdles

Though federal funds for the PPP program were funneled through the SBA, banks were accepting applications and issuing loans. Participating lenders received guidance for the application process, including eligibility criteria and required documents, on April 2, hours before the program was set to open. With little time to review the guidelines, some large banks were late to begin accepting applications and many prioritized customers with existing banking relationships.

The majority of our survey respondents — 62% — applied for a PPP loan through a bank where they were an existing customer, while 23% applied online through a third party. The first day PPP loans became available, 31% of business owners applied for funding. Another 32% submitted their applications in the following four days.

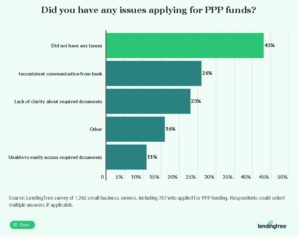

There were problems with the application process for 57% of business owners. The two most common issues were:

- Inconsistent communication from the bank (26%).

- A lack of clarity around the required documentation (23%).

Additionally, about one in 10 applicants had difficulty compiling all of the required documents. Because PPP loan amounts are calculated based on a business’s payroll costs, applicants needed to provide payroll documentation, including IRS forms and payroll statements.

Atkinson of College H.U.N.K.S. applied for a PPP loan through a local branch of Fulton Bank where the business has a money market account, business checking account and a line of credit. His application process was straightforward, but colleagues who applied through smaller banks seemed to hear back more quickly.

“I have business contacts that opened small accounts with local credit unions and their process took three days from application to receipt of funds,” Atkinson said. “My bank had 13,000 applications and it has been two-plus weeks with still not so much as an approval.”

58% of small business owners cut workforce due to COVID-19

Among survey respondents, 58% have laid off employees because of coronavirus-related circumstances. Our small business survey from late March showed that 37% of owners had laid off workers.

The number will likely continue to increase as business owners who haven’t yet had to lay off employees expect to do so at some point. Among those who haven’t implemented layoffs, 11% said they expect to do so in the near future, while 55% simply said it is a possibility.

One survey respondent recognized the anxiety that workers feel during this time: “The most difficult part is desperately trying to communicate with our employees to help ease their tensions and worries, while also being transparent and honest — yet we barely understand what is going to happen next. This is all tough.”

Businesses in some industries are more likely to make staff reductions than others:

- Accommodation and food services: 82%

- Administrative and support, and waste management: 75%

- Mining, quarrying and oil and gas extraction: 75%

- Arts, entertainment and recreation: 68%

- Manufacturing: 65%

On the other hand, employees may be safest in industries where layoffs are least likely to occur:

- Management of companies and enterprises: 20%

- Information: 22%

- Real estate and rental and leasing: 31%

- Wholesale trade: 35%

- Finance and insurance: 36%

How PPP loan recipients plan to spend funds

Of those who did receive a PPP loan, 88% plan to use the money for payroll. Business owners must spend at least 75% of their PPP loan on payroll to be eligible for loan forgiveness. The remaining 25% may go toward rent or mortgage payments and utilities to qualify for loan forgiveness.

Outside of payrolls, survey respondents anticipate using loan funds to cover one or more of these costs:

- Rent or mortgage: 59%

- Utilities: 50%

- Interest on pre-existing loans: 29%

- Benefits: 18%

Most business owners — 74% — plan to use their PPP loan as soon as they receive it. The average amount loaned to survey respondents was $49,335.40. The majority of recipients — 68% — said they were approved for the exact amount they requested, while 15% got more than they asked for and 18% received less than they wanted.

Of those who received the money, 56% said it’s enough to reopen or continue operations for 90 days, but 27% said it’s “definitely not” enough to keep the business afloat.

Where to turn if your PPP loan wasn’t approved

Beyond the PPP, which may or may not receive more funding to continue, small business owners can turn to alternative online lenders, local financing programs and other government loans for emergency assistance.

Online business loans

Nonbank online lenders can provide fast emergency business loans. If your business meets the eligibility requirements, you could receive same-day funding once approved.

Note that, however, emergency financing options, such as short-term loans, lines of credit and merchant cash advances, may have quick repayment terms and high interest rates. Be sure your business could keep up with payments, which could start immediately, before applying for an online business loan.

Local relief programs

Many cities and states have created programs to assist small businesses during the coronavirus pandemic. You may be able to secure low-interest financing solely designated for local small businesses affected by the crisis.

Check with your city’s Chamber of Commerce or another regional business organization to find information regarding COVID-19 resources for local businesses. Reach out to your state’s Department of Economic Development or a similar entity for any statewide relief that may be available.

Main Street Lending Program

The Federal Reserve is putting $2.3 trillion toward its Main Street Lending Program, which is designed to help small and medium-sized businesses survive the coronavirus pandemic. The loans, which are not yet available, will be $1 million to $25 million or more with four-year repayment terms that include the option to defer interest for one year.

To be eligible, businesses can employ up to 10,000 people. Additionally, businesses must have had $2.5 billion or less in 2019 revenue. If your business meets the requirements, you can apply through eligible lenders when the program opens.

Methodology

LendingTree conducted an online survey of 1,260 small business owners who had previously applied for funding through LendingTree’s small business lending database. Of the total respondents, 757 business owners had applied for a PPP loan. Participants were emailed a link to participate in the survey, which was fielded using Qualtrics from April 16-19, 2020.

Author: Melissa Wylie is a Senior Small Business Writer covering small business financing for LendingTree.com and LendingTree-owned domains MagnifyMoney and ValuePenguin. In her role, Melissa explores all aspects of business ownership, from the start to the sale to all the hurdles in between.